Client Resources

Tax Season Welcome Letter and Best Practices

To read our annual welcome letter and tax season best practices document, please click on the link below.

How to Work with Us Remotely

We use a secure, intuitive client portal to help ease the communication between us and our clients. Here are some of our favorite features:

Everything is in one place: you can electronically sign documents, complete organizers, and upload documents without going to multiple websites all from your mobile phone or computer.

It helps maintain a secure exchange of information & safety of your personal data. TaxDome has a built-in secure messaging system, where we can request information we need from you or chat in real time.

It is mobile friendly, so you can access it anytime, anywhere!

Access the portal HERE.

Appointments

Appointments will be via phone or Zoom. In-person appointments are currently closed for our team’s safety. They are based on the first-come, first-served policy. The last day for appointments will be March 25, 2023. Please be sure to bring in your documents as soon as possible so that you’re able to have your time slot before then.

Appointments will only be scheduled on the following days and times:

Tuesdays / Thursdays / Saturdays: 10:00am – 4:00pm (Saturdays start February 12 and end March 25, 2023)

If you would like to schedule an appointment, please click below to request a link to be sent to you.

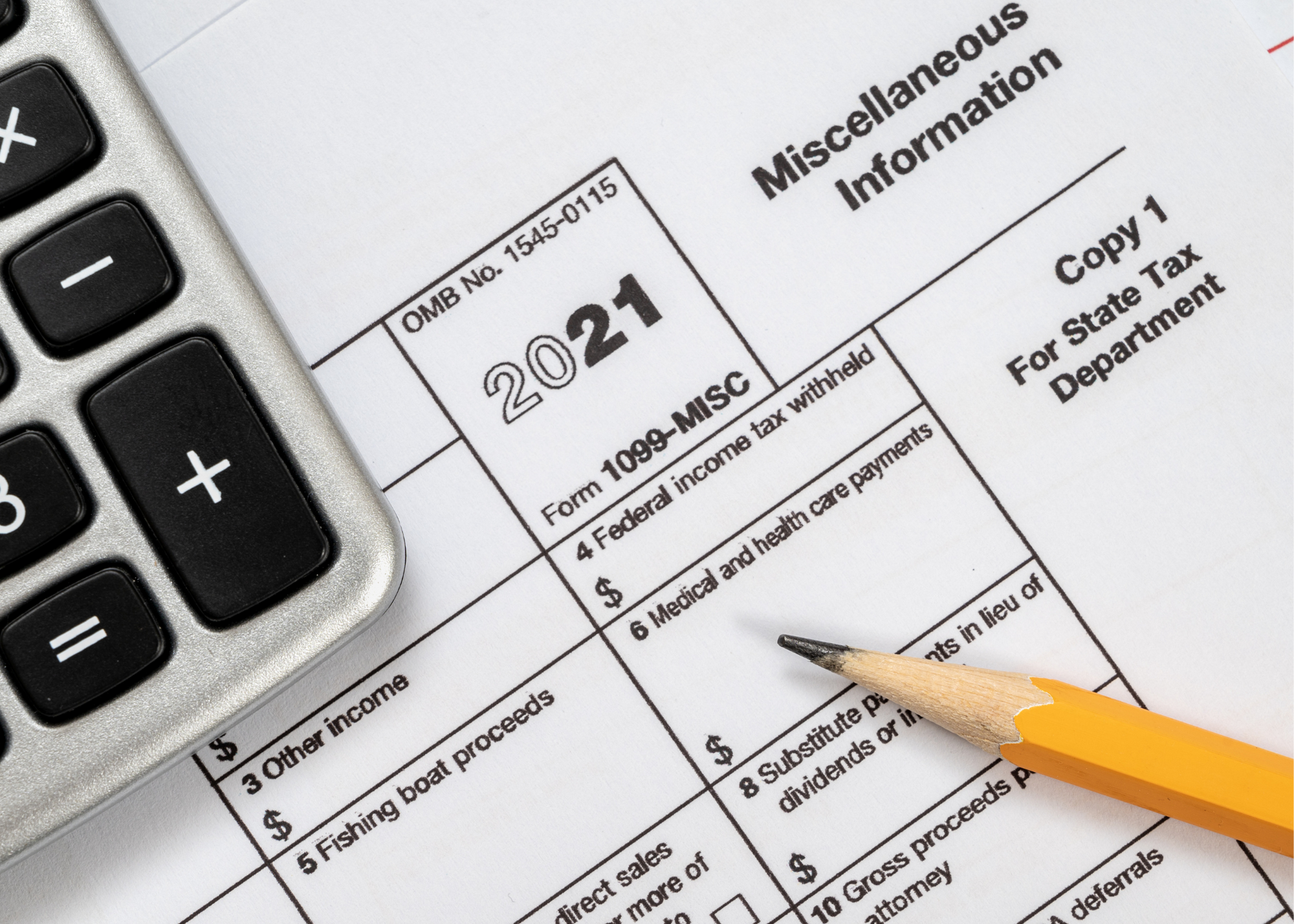

Form 1099 Preparation

Business owners are required to issue a 1099-NEC to independent contractors, sole proprietors, partnerships, and LLCs taxed as partnerships who are paid $600 or more during the year for services performed during the normal course of business. 1099-MISC are required for other payments of $600 or more, such as rents and payments to an attorney. These forms are due by January 31 each year. If you have signed your engagement letter, please complete the data collection form using the link below and upload it to the client portal when done.

Refund Status

Click on the link below to access the IRS’s “Where’s My Refund” service. You will need your Social Security Number, your filing status, and your exact refund amount. Please refer to your tax return provided to you for this amount.

Pay the IRS Electronically

The IRS offers two methods for making tax payments electronically – Direct Pay and the Electronic Federal Tax Payment System, also known as EFTPS. Direct Pay is generally better for one time or occasional payments, while EFTPS is ideal for taxpayers who make regular online tax payments.

Pay Your Bill

Don’t want to mail a check? We have an easy way to pay your invoice right here! You can use credit or debit card, or you can choose to make a payment directly from your bank account. This method is safe and secure through our client portal. You will need to login to your portal account to pay your bil.